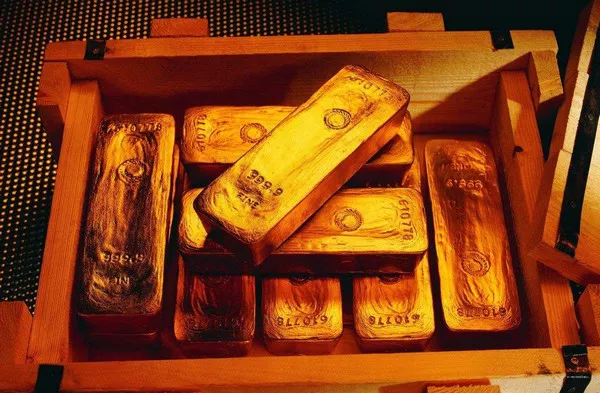

Gold prices (XAU/USD) displayed a slight negative bias during the first half of the European session on Monday, marking a pause after a four-day winning streak that lifted the metal to a one-month high last week. The shift comes amid a stronger-than-expected U.S. Nonfarm Payrolls (NFP) report, which has reinforced market expectations that the Federal Reserve (Fed) may pause its rate-cutting cycle later this month. As a result, U.S. Treasury bond yields remain elevated near their highest levels in over a year, while the U.S. dollar (USD) continues to trade at a two-year peak, exerting pressure on gold.

Meanwhile, the market’s cautious sentiment toward riskier assets, driven by a hawkish Fed outlook and ongoing geopolitical tensions, has helped support gold as a safe-haven asset. However, analysts caution that it is too early to declare the recent gold rally over. Investors are awaiting the release of U.S. inflation data this week, which could provide further direction for the precious metal.

Fed’s Hawkish Stance and Robust Employment Data Weigh on Gold

The U.S. Bureau of Labor Statistics reported on Friday that December’s Nonfarm Payrolls increased by 256,000, surpassing expectations of 160,000 and the previous month’s gain of 212,000. This data, along with a drop in the unemployment rate to 4.1% from 4.2% and a slowdown in annual wage inflation to 3.9%, has dampened hopes for further interest rate cuts by the Fed. The hawkish shift by the central bank has pushed U.S. Treasury yields higher, with the 10-year government bond yield reaching its highest point since late 2023. Additionally, the USD Index, which measures the dollar’s performance against a basket of currencies, surged to a two-year peak, adding to the headwinds faced by gold.

Although elevated bond yields and a strong dollar are challenging gold’s rally, the risk-off sentiment in global markets, fueled by geopolitical developments, continues to offer support for the yellow metal. Notably, tensions between Russia and Ukraine persist, with Russia conducting strikes on Ukrainian military sites, while renewed Israeli airstrikes have been reported in Gaza and Lebanon. These factors have led to cautious investor behavior, driving interest in gold as a safe-haven asset.

Gold’s Technical Outlook: Support Levels and Potential for Dip Buying

From a technical perspective, gold prices are expected to find support near the $2,665-$2,664 area. A further decline could push prices towards the $2,635 region, with additional support at the $2,605 level, where the 100-day Exponential Moving Average (EMA) and an ascending trendline converge. On the upside, the $2,700 mark is seen as a key level for gold bulls to watch. A sustained move above this threshold could signal further upside momentum, with targets at $2,715, $2,730-$2,732, and the $2,746-$2,748 supply zone.

With oscillators on the daily chart showing positive momentum and far from overbought territory, the outlook for gold remains constructive. Despite the recent dip, market sentiment suggests that the yellow metal’s bullish trend could continue, with buying opportunities likely to emerge at lower levels. Investors are advised to monitor the upcoming U.S. inflation data and geopolitical developments for further cues on the gold price trajectory.

Conclusion

While gold prices face short-term headwinds from a hawkish Federal Reserve and robust U.S. economic data, the metal’s safe-haven appeal remains intact amid ongoing geopolitical tensions and a cautious market sentiment. The technical outlook suggests that gold could find support at lower levels, potentially setting up buying opportunities. Investors are advised to closely monitor upcoming U.S. inflation figures and geopolitical events, which could provide the necessary catalysts for gold to either regain its upward momentum or extend its corrective move.